The Future of Business Travel in 2025: Innovations Shaping the Future of Travel.

Focus on travel trends and how B4B Payments expense management tools help minimise risks and control expenditures for tour operators and business travellers alike.

Here at B4B Payments we’re interested in the travel industry because our clients are interested in travelling. On a macro scale, 2024 has shown a continued bounce back in travel since the pandemic though at a decelerating rate as spend reverts back to the mean, a study by UN Tourism Barometer.

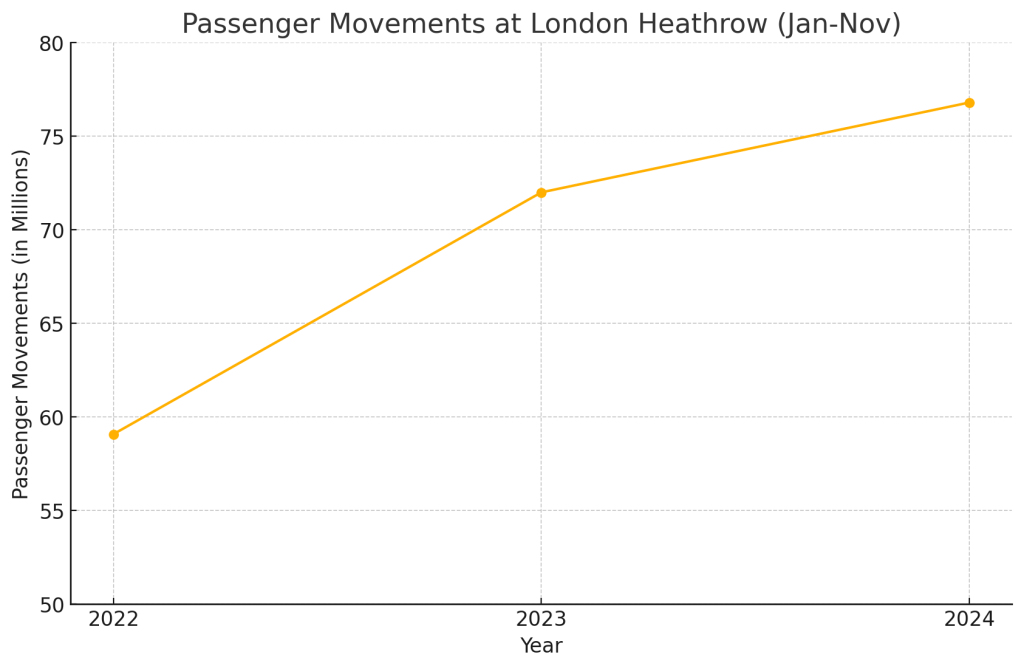

For example, London Heathrow shows a healthy 6% growth Jan-Nov 2024 over the same period in 2023, a total of 76.8M passenger movements. However, the same statistic for 2023 over 2022 was 30%.

A 6% growth in 2024 indicates that travel demand remains healthy but is stabilising rather than experiencing dramatic spikes. Original source

Continued growth will now depend more on product, price and innovation whilst still being subject to exogenous events such as conflicts or economic performance as well as a growing movement towards sustainability.

Our clients can be divided into two when it comes to travel:

Firstly, those clients who are directly involved in the travel business themselves.

Secondly – and more broadly – the day to day expenses of our business clients as they travel to see their own customers, colleagues and attend conferences.

Let’s take the first group – direct travel clients.

We have a large – and increasing – portfolio of tour operators who use our payments services. The focus here tends to be on supporting group travel and our cards are perfect for tour directors to meet the on-the-road expenses involved with shepherding customers from one location to another.

Primarily our businesses have concentrated on the European market where tourists from the US and elsewhere want to hit the highlights of Europe; London, Paris, and the Southern Med for example.

Take Expat Explore who offer a multitude of tours to take in the sights of Europe. Customers get an experience of different cities, countries and cultures in a concentrated period of time. Our cards are used on the tours to help Expat minimise risk, control expenditure and make sure the right funds hit the right card at the correct time.

But what we’ve noticed at B4B is an increasing shift from our travel clients towards more far flung destinations over the last couple of seasons. Japan’s hot right now, as is Vietnam, Korea and Australia. It seems travellers since the pandemic – moving away from revenge travel – have decided to value new experiences highly by travelling out of region.

Business travel spend – i.e. spending by companies travelling to meet clients and attend conferences – is a more difficult trend to isolate and project into 2025. This is where economic sentiment and technology advances meet head to head.

Firstly, the economic environment. It’s well known that meeting clients and prospective clients is a good business strategy, a report by BSS Commerce. It increases sales and allows more interaction, formal and informal, with clients for the benefit of both. However, in an uncertain economic environment, the continual wrestling match between sales/marketing and finance really comes to a head. Travel and entertainment is a discretionary budget and is often the first item to be squeezed should the economy take a turn for the worse.

Secondly, one lesson of COVID is that companies can conduct meetings online via Zoom, Teams, Google Meet etc. Ally this to a larger focus on corporates reducing their environmental imprint and potentially we have a nexus where the expedient meets the virtuous. A great deal will depend on the global economic outlook report by Mastercard– in the next 12 months which is uncertain, but is predicted to be similar to 2024.

Conclusion

Whether an industry professional or a company traveller, a decent expense management system helps manage costs, mitigate risks and understand spending patterns. At B4B, we have a long history of helping clients manage their expenses, helping them to maximise resources to focus on their primary business.

But nothing stands still and, in 2025, B4B will be further investing in our expense management capabilities so our clients can continue to take advantage of our experience and services. There will be an aggressive roll out schedule across the year. We will be in touch but if you wish to understand our future developments – or wish to contribute ideas – please contact your account manager.

Tim Robson

Director of Accounts and Partnerships, Dec 2024