The Nordic banking industry is one of the world’s most technologically advanced, secure, and reliable.

With high levels of digital adoption among consumers, coupled with comparatively high disposable income, it presents a potentially lucrative opportunity for fintechs looking for growth.

In this blog post, we’ll explain what makes it unique and how you can capitalise on the opportunity.

The Nordic Banking Landscape

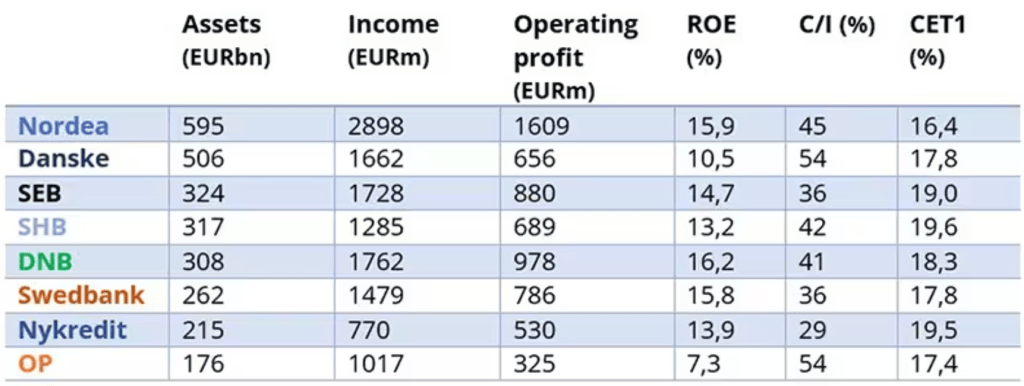

The Nordic banking industry is one of the best in the world, headlined by Nordic giants such as Nordea Bank, SEB, and Swedbank. The combination of profitability, efficiency and risk management makes for some impressive reading, as shown below.

Major Nordic bank results for Q4 2022, Deloitte.

Within such a fertile environment, the future of the fintech landscape also looks excellent. For example, the number of people using digital payments is expected to rise to over 27 million by 2028, which is the entirety of the Nordic population.

The players within the fintech startup ecosystem also have a high trust culture of sharing information, which is crucial for the rapid development of the industry.

Mobile banking

The Nordic region has high adoption rates when it comes to making mobile payments. The region as a whole has some of the lowest rates of cash usage globally.

Sweden | Norway | Finland | Denmark | |

| Percentage of people who never use cash | 48% | 40% | 10% (rapidly increasing) | 27% |

Consumers are embracing mobile payments, with the Nordic region as a whole reaching adoption rates ranging between 83%-94%, 10%-15% higher than the European average.

This is partly due to some incumbent banks, such as DNB, launching their own payment platform, Vipps, which has a penetration rate in the Nordics of over 75%. Another example is Mobile, from the central Nordic bank DNB, which has a market penetration of 93% in Norway.

Sustainability

Nordic fintechs have been set to remain at the forefront of sustainable financial development.

They’ve been exceptional at balancing the need for financial performance with environmental responsibility. Those impressive numbers at the beginning of this blog post were achieved whilst being proactive about financial products such as carbon offset platforms and sustainable investment tools.

A semi-recent example of this is Doconomy’s acquisition of Dreams Technology.

Doconomy is a leading climate tech startup. It helps banks, brands, and consumers get insights about their spending habits and how they may affect the environment. This acquisition will enable banking customers to make more climate-conscious consumption decisions.

Secure Payments

The Nordics’ robust banking regulations framework means that consumers have a high level of trust when it comes to using payment platforms. This supports the strong adoption rates, which are an excellent basis for new market entrants.

An example of this is the popularity of Sweden’s Trustly. Trustly is an open banking fintech that enables consumers to pay for products and services securely without sharing their bank details. This offers consumers valuable peace of mind as they don’t have to worry about their bank details being compromised when purchasing.

Partnerships and collaboration

In late 2023, Enable Banking, CRIF and Strands, three leaders in the Nordic fintech space, announced a partnership to bring Open Finance Solutions to the Nordic regions.

The partnership will be pivotal to open banking APIs’ growth and connectivity to financial products such as loans, pensions, and credit facilities. Major banks, fintechs and other financial institutions will be able to collaborate by sharing data and delivering innovative products and services to consumers and businesses.

This is paving the way for new market entrants who may have missed the initial first-mover advantage at the start of the revolution started by PSD2.

Also, it makes up for the collapse of the hugely promising P27 initiative. This would have made cross-border transactions between the Nordic countries and their different currencies seamless.

The opportunity

Fintechs have an opportunity to make essential inroads via innovators and early adopters of payment technology.

There is less need to educate consumers about the benefits of payment tech. They already know it and have seen the benefits.

The journey to market and profitability is being accelerated in the region. They’re a demanding population, but the rewards can be extensive if you meet their high standards.

However, to access these rewards, fintechs must comply with some of the most robust banking regulations in the world, as it can be challenging to break into the Nordics via a banking licence.

B4B Credentials

B4B enables fintechs to take advantage of lucrative opportunities. We do this via an infrastructure-based partnership with them. We provide back-end services so that they can serve their customers via card issuing or other financial products.

Take one of our clients, Juni. We’ve been working with them since 2022 as their BIN sponsor. This was the engine behind their prepaid Mastercard card proposition and made it easy for businesses to keep track of their finances across multiple platforms. By partnering with B4B, they can ensure compliance, strengthen their presence in the UK, and enhance scalability.

Samir El-Sabini, Co-founder and CEO of Juni, highlighted the benefits of partnering with B4B.

“We have a long-standing partnership with B4B, primarily in the UK, that has enabled us to scale Juni and continue our fast-paced growth while, most importantly, giving our customers more value when using our platform. Through B4B, we’ve launched both new currencies and cards, and we’re looking forward to building out our offering in 2024.”

Conclusion

The Nordic region is a hotbed for fintechs to expand their presence. Partnering with B4B can make that process a smooth, stress-free experience for everyone involved.

B4B Payments Finalists for FinTech Partner & Team of the Year at UK FinTech Awards 2025

Streamlining Payroll and Payments in the Public Sector

Consumer vs. Corporate Lending: How Embedded Payments Are Transforming Both