As COVID-19 lockdown restrictions begin to ease around the world, many sports fans and athletes are rejoicing as sports games and tournaments are preparing to resume once again. If you’ve recently been put in charge of the sports payments for a travelling sports team, ensure you follow our guidance below…

DO elect a team treasurer

If you are unfamiliar with managing a travelling sports team or have never handled sports payments before, you may be tempted to split the financial responsibilities of your sports team. This, however, will only lead to confusion and make your finances difficult to manage and organise. Instead, elect one treasurer and find a simplified financial system, such as a prepaid payment solution, that will unify your financial expenditure.

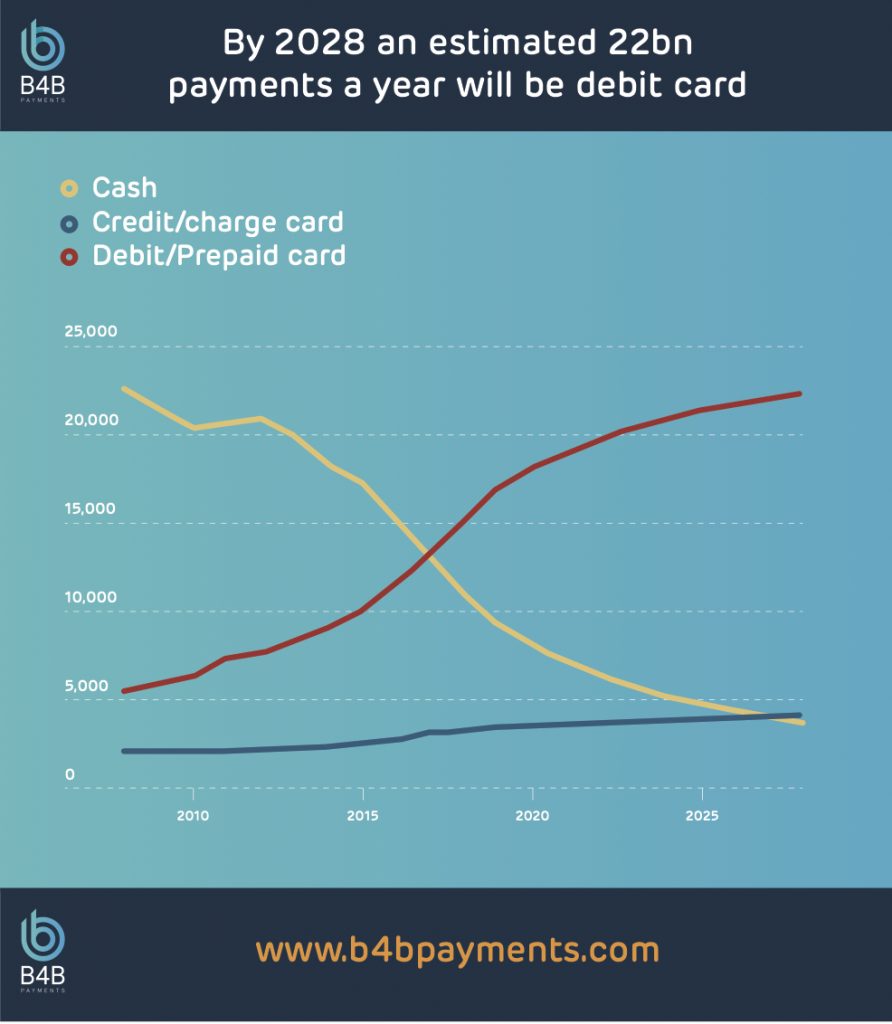

DON’T use cash

Whether you manage a small grassroots sports team or an international team of athletes, you should avoid travelling and paying for services with cash where possible. When you travel with cash, you make yourself incredibly vulnerable to theft and put yourself at risk of fraud. With cash, it is almost impossible to track your team’s spending and can be very time consuming to manage and distribute.

In light of recent global events, avoiding the use of cash where possible is essential. Many businesses will only now accept contactless card payments due to the social distancing measures put in place due to COVID-19. Cashless card payments will help to reduce the spread of the virus and help safeguard your sports team and employees from putting themselves at risk of infection.

DO stick to your budget

To ensure you don’t overspend and harm the financial position of your sports team, it is essential you create a precise budget and stick to it. Pre-paid cashless payment cards will ensure your sports team do not go over budget as they will have a specific amount allocated to their card. It will also be easier to track where you have been overspending due to their digital spend visibility.

B4B Payments, voted the Best Prepaid Product of the Year in 2019, offers payment solutions without regional limitations, as they are Mastercard® approved, ensuring your team can travel with ease without having to change payment type frequently.

DON’T mix funds

If you manage multiple sports teams it may be tempting for you to only open one bank account and blend all of your funds and expenses. It is essential, however, that each sports team you manage has a separate bank account and you do not use your personal account to keep any of your sports team expenses.

DO create a payment plan

As sports games begin to take place once again, it is essential you keep your team safe and your finances organised. This is why before hosting or attending a sports event you should contact B4BPayments, to order your prepaid business cards. All prepaid cards are managed with a robust, flexible, and easy to use digital platform and mobile app.

To learn more about how sports events and other organisations are benefitting from contactless payment solutions read our customer stories.