Kitchen Sink

This page serves as a reference for all custom blocks and cannot be edited in Wordress. More recent blocks are now available as shortcodes for easier use and maintenance.

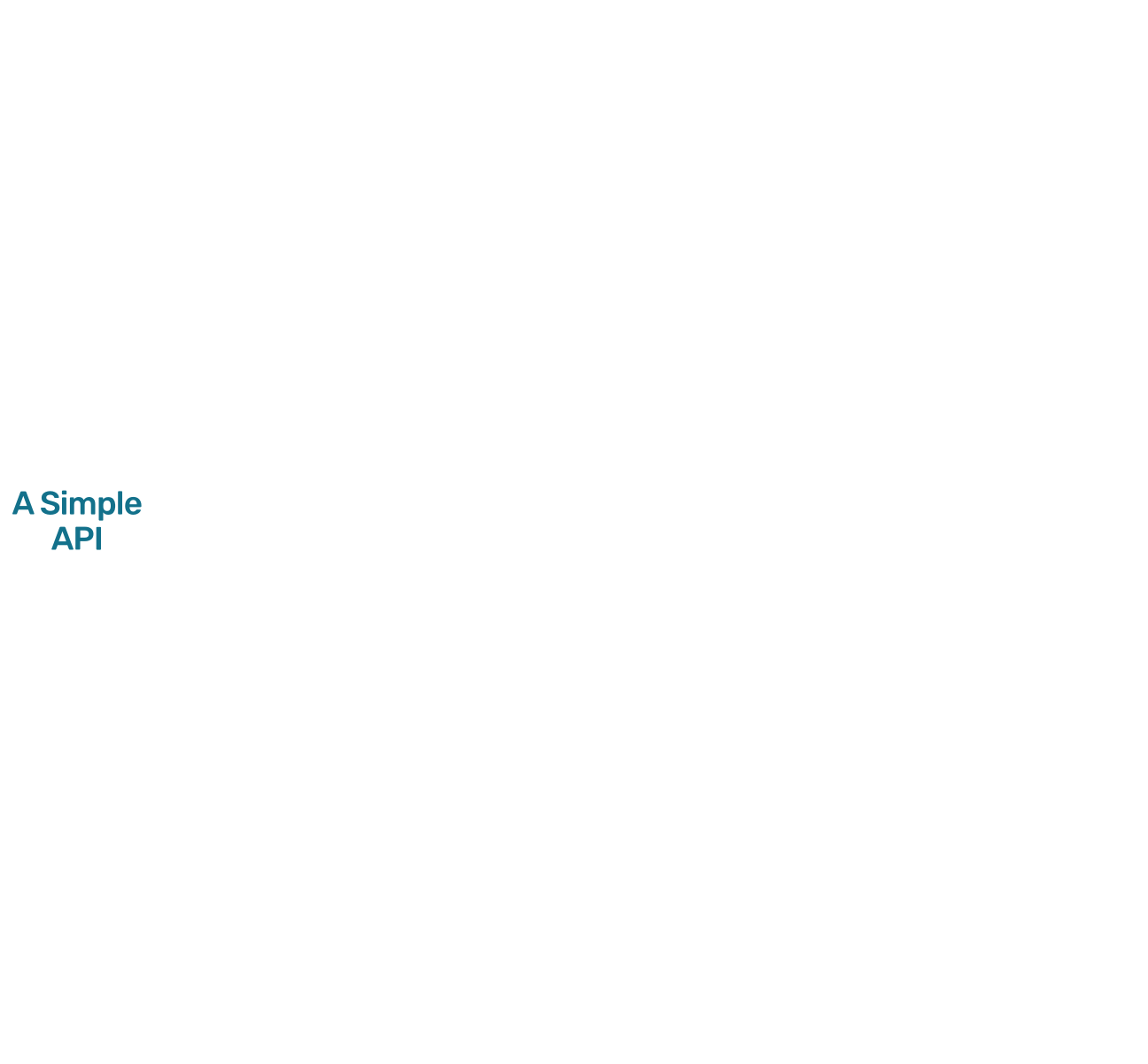

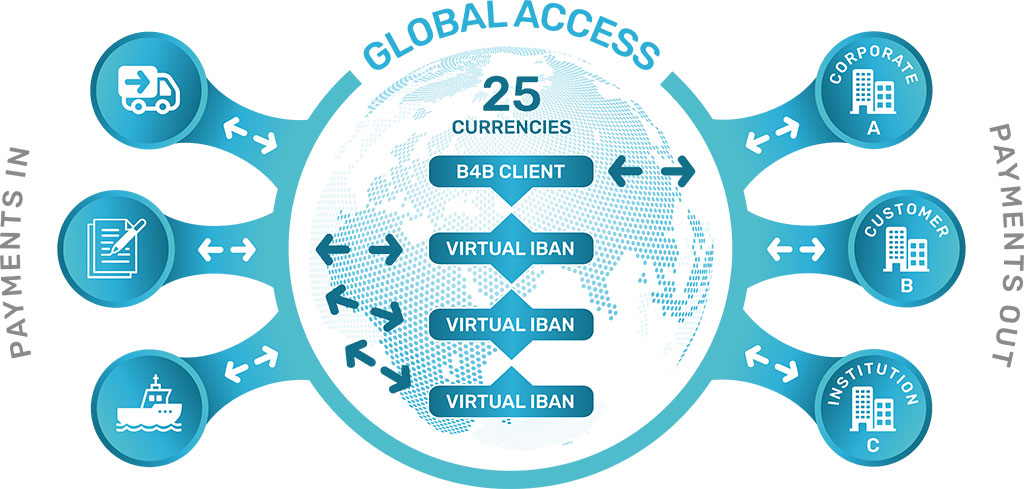

APFX - Manage Funds

Allow your customers to create accounts, collect and hold function and issue multiple VIBANs

BaaS LP

Shortcode: [b4b-baas-lp]

BaaS LP (Columned)

Shortcode: [b4b-baas-lp-columned]

Tailor your financial offerings seamlessly on top of B4B’s Licences and Banking Stack, including:

Streamlined Onboarding:

Compliance and KYB

Secure Financial Crime Solutions:

Risk Management | Transaction Monitoring | Sanctions Screening | Fraud Prevention

Propositions:

Business Accounts | Payments & FX | Card Payments and Issuing | Expenses

Infrastructure:

Treasury | Ledger | Reconciliation

Customer Operation:

Customer-first | Developer-first | Multi-regional | Support | Business-model Diagnostic

About Us Timeline

Shortcode: [b4b-timeline]

BaaS Infographic v2

Shortcode: [baas-infographic-v2]

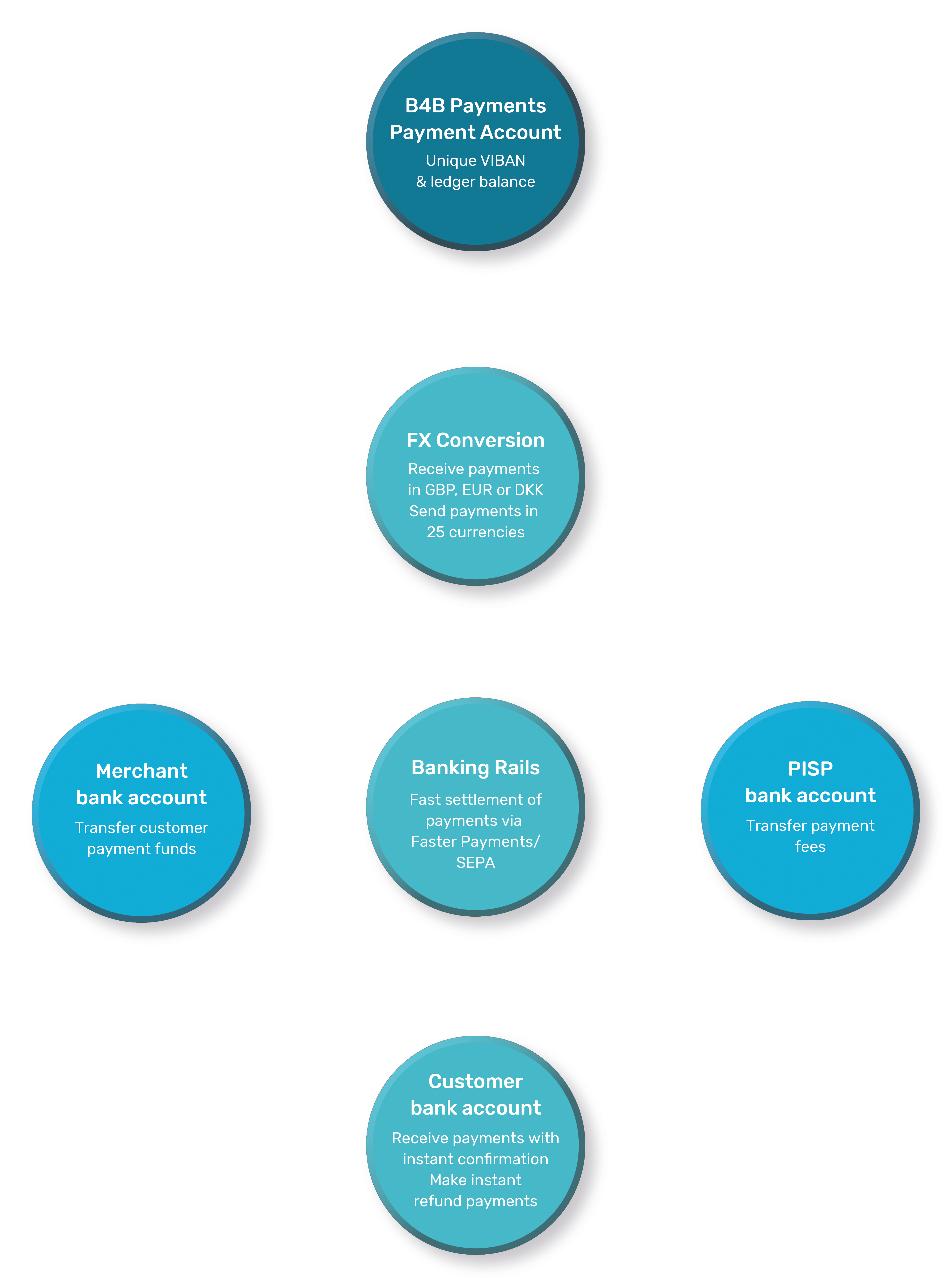

Banking as a Service

Card Issuing

Shortcode: [card-issuing-infographic]

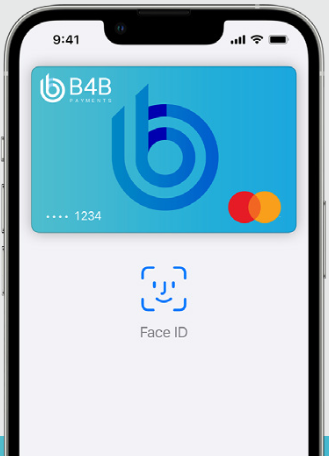

It's easy to customise your cards. Choose physical or virtual, add branding, set store or spend type restrictions and more via our powerful platform.

Prevent unauthorised spend, reduce fraud risk and stay compliant with KYC checks, biometric logins and instant card blocking.

Cards can be added to Apple or Google wallets for seamless mobile payments, and virtual cards make distribution a breeze.

Cardholders can spend in millions of locations worldwide. Keep control with real-time transaction data, photo receipts and API integration.

B4B’s environmentally-friendly card is made with material from 76% recycled post-industrial waste helping to reduce your carbon footprint year on year.

Baas Infographic

Shortcode: [card-issuing-infographic]

Accounts

customers to

create accounts

collect and hold

funds and

issue multiple

VIBANs

domestic and

international

payments

at scale

hold funds in

multiple currencies

to support settlement

for you or your

customers

multi-currency

cards to your

customers

anywhere, in your

branding

Interactive - How it works

Shortcode: [how-it-works]

Load

Add funds to your issued cards via your management platform, individually or in bulk, or set daily auto top-ups to a defined limit. Funds reach your cardholders instantly.

Issue

Issue ten cards, or tens of thousands! Have us deliver to your cardholder’s address, keep a stock of cards on your premises ready for activation, or send virtual cards via email.

Personalise

Make your cards stand out with personalised branding. If you’re issuing more than 200 cards, you’ll have the option to add your logo and designs to your cards and cardholder app.

Control

Set your cards to closed-loop (in-store) or open-loop (spend anywhere). Restrict online transactions or ATM use if required. Unload or block cards instantly.

Pay

Send and receive global multi-currency payments using SWIFT, Faster Payments, CHAPS, SEPA, ACH and more, at the current exchange rate with no hidden fees, via our platform or using our API.

Monitor

View real time statements, balances and transactions via our leading business payment platform. Automatically prompt cardholders to provide photo receipts for expenses via the cardholder app.

Report

Easily categorise transactions for reconciliation. Connect seamlessly with Xero, or integrate with our robust API.

Use Cases

What could B4B do for you?

Our clients are always finding new ways to use expense, incentives and payout cards.

Search Form

Infographic v2

Sponsorship

for PISPs

Accounts and Cards

& Rewards

Cards

Expenses

Cards

Payments

Currencies

Accounts

Infographic

Flexible payment accounts

Instant global payments

Make and receive high volumes of payments at attractive rates in 25 currencies, including SEPA, Faster Payments, CHAPS, USD ACH, DKK intraday and SWIFT. The account holders name is included on the bank statement of the beneficiary, so they can easily recognise the payment.

Low-cost FX

Make FX transactions in 25 currencies between your accounts or as part of an incoming or outgoing payment. Competitive pricing with no hidden fees. Up front-rates during bank opening hours.

Card Ts&Cs

UK

B4B Payments prepaid Mastercard® Terms and Conditions. The following Terms & Conditions definitions apply to UK issued B4B Payments clients and cardholders.

Client Terms & Conditions

Enterprise Client:

is a business which both: (a) employs more than 10 people; and (b) has a turnover or annual balance sheet exceeding £2 million.

Small Business Client:

(a) employs fewer than 10 people; and (b) has a turnover or annual balance sheet that does not exceed £2 million. Or a charity is a body whose annual income is less than £1 million and is: (a) in England and Wales, a charity as defined by section 1(1) of the Charities Act 2011; (b) in Scotland, a charity as defined by section 106 of the Charities and Trustee Investment (Scotland) Act 2005; or (c) in Northern Ireland, a charity as defined by section 1(1) of the Charities Act (Northern Ireland) 2008.

Enterprise Corporate Terms and Conditions

Small Business Corporate Terms

Card User/Holder Terms:

Enterprise Card User Terms

For users of B4B enterprise expense and incentive products.

Small Business Card User Terms

For users of B4B small business Expense and Incentive products.

Cardholder Terms

For recipients of funds using B4B Payout and Payroll products.

Bread4Scrap Terms & Conditions:

EU

The following Terms & Conditions definitions apply to B4B Payments UAB clients and cardholders located in Europe, outside of the UK.

Client Terms & Conditions:

Europe Business Terms & Conditions [English]

Europe Business Terms & Conditions [Lithuanian]

Card User/Holder Terms:

Europe Card User Terms & Conditions [English]

Europe Card User Terms & Conditions [Lithuanian]

For users of B4B Payments EU expense and incentive products located in the EU.

Europe Cardholder Terms & Conditions [English]

Europe Cardholder Terms & Conditions [Lithuanian]

For recipients of funds using B4B Payout and Payroll products located in the EU.

U.S.

B4B Payments prepaid Visa® Terms and Conditions.

Card User/Holder Terms:

Business prepaid Visa® Cardholder Agreement

Incentive prepaid Visa® Cardholder Agreement

Payout prepaid Visa® Cardholder Agreement [English]

Payout prepaid Visa® Cardholder Agreement [Versión en español]

Locations

21-24 Millbank

London

SW1P 4QP

Didžioji

G. 18

Vilnius

Lithuania, LT 01128

40 Washington Street

Suite 150,

Wellesley, MA. 02481

Hero with Video

Interactive - What can we do?

Interactive - Banking as a service

accounts and card issuance

Interactive - Bin Sponsorship

businesses

without a scheme licence

scheme permissions

Platform Features

Interactive - Reconciliation

scheme permissions

confirmation and reconciliation

Hero

Switched-on global

payment solutions

Image + Text

Card Services

Whoever you need to get funds to, our turnkey system gives you everything you need to create and manage a secure, flexible payment scheme for your business. We offer everything you need to launch a card programme, with advanced features, full flexibility and industry-leading security.

Benefits Detailed (Icon Above)

Whatever your business objective, we can help you grow with the power of scalable and secure payments

We offer everything you need to launch a card programme in a single turnkey solution, with advanced features, full flexibility and industry-leading security.

Corporate

Businesses of all sizes can save time, money and hassle with our simple, powerful all in one card, payment and FX platform.

Corporate

Businesses of all sizes can save time, money and hassle with our simple, powerful all in one card, payment and FX platform.

Corporate

Businesses of all sizes can save time, money and hassle with our simple, powerful all in one card, payment and FX platform.

Corporate

Businesses of all sizes can save time, money and hassle with our simple, powerful all in one card, payment and FX platform.

Corporate

Businesses of all sizes can save time, money and hassle with our simple, powerful all in one card, payment and FX platform.

Benefits Detailed (Icon Left)

Whatever your business objective, we can help you grow with the power of scalable and secure payments

We offer everything you need to launch a card programme in a single turnkey solution, with advanced features, full flexibility and industry-leading security.

Corporate

Businesses of all sizes can save time, money and hassle with our simple, powerful all in one card, payment and FX platform.

Corporate

Businesses of all sizes can save time, money and hassle with our simple, powerful all in one card, payment and FX platform.

Corporate

Businesses of all sizes can save time, money and hassle with our simple, powerful all in one card, payment and FX platform.

Corporate

Businesses of all sizes can save time, money and hassle with our simple, powerful all in one card, payment and FX platform.

Corporate

Businesses of all sizes can save time, money and hassle with our simple, powerful all in one card, payment and FX platform.

Image on Blue

Buttons

Logo Strip

Promo

B4B with Apply Pay

Benefits Simple

Cost-efficient and fast

For high volumes of local and international payments ,we offer better transaction and FX rates and faster settlement times than a high street bank.

Cost-efficient and fast

For high volumes of local and international payments ,we offer better transaction and FX rates and faster settlement times than a high street bank.